Automating 2026 Finances: ‘Pay Yourself First’ for 20% Savings

Automating your 2026 finances through a ‘Pay Yourself First’ system is crucial for achieving financial stability, ensuring at least 20% savings by prioritizing your financial future consistently and effortlessly.

Are you ready to take control of your financial destiny in 2026? The concept of Automating Your 2026 Finances: Setting Up a ‘Pay Yourself First’ System for 20% Savings (Insider Knowledge) is not just a catchy phrase; it’s a powerful strategy designed to transform your financial health. By prioritizing your savings before expenses, you can build wealth systematically and achieve your financial goals with unprecedented ease. This article will guide you through the essential steps to implement this robust system, ensuring you secure your financial future.

Understanding the ‘Pay Yourself First’ Philosophy

The ‘Pay Yourself First’ philosophy is a cornerstone of sound personal finance, advocating for the prioritization of savings and investments before any other discretionary spending. This approach flips the traditional budgeting model, where savings often become an afterthought, dependent on what’s left after bills and lifestyle expenses. Instead, it positions your financial future at the forefront of your monetary decisions.

In essence, it means treating your savings like a non-negotiable bill. Just as you wouldn’t typically skip a rent or mortgage payment, you commit to setting aside a predetermined portion of your income for savings and investments the moment you receive it. This proactive strategy ensures that your financial goals, whether it’s building an emergency fund, saving for a down payment, or funding retirement, are consistently addressed.

Why ‘Pay Yourself First’ is Crucial for 2026

As we navigate the complexities of 2026, economic shifts and evolving financial landscapes make this principle more vital than ever. The proactive nature of ‘Pay Yourself First’ provides a buffer against unforeseen circumstances and accelerates wealth accumulation. It removes the psychological burden of choosing to save, making it an automatic, integral part of your financial routine.

- Guaranteed Savings: Ensures money is allocated to your financial goals before it can be spent elsewhere.

- Reduced Financial Stress: Knowing your savings are on track provides peace of mind.

- Compounding Growth: Early and consistent savings maximize the power of compound interest.

- Discipline Building: Cultivates a healthy financial habit without requiring constant willpower.

By making savings automatic and non-negotiable, you create a powerful financial habit that supports long-term prosperity. This foundational understanding is the first step towards effectively automating your 2026 finances.

Setting Your 20% Savings Goal: Why and How

Establishing a clear savings goal is paramount to any effective financial strategy. For 2026, aiming for a 20% savings rate is an ambitious yet achievable target that can significantly accelerate your journey toward financial independence. This percentage isn’t arbitrary; it balances current lifestyle needs with future financial security, making it a widely recommended benchmark by financial experts.

The ‘why’ behind a 20% savings goal is multifaceted. It provides a substantial contribution to various financial buckets without overly restricting your present spending. This rate allows for meaningful progress towards retirement, emergency funds, and other short-to-medium-term goals, fostering a sense of accomplishment and momentum. Furthermore, consistently saving 20% of your income dramatically reduces the time it takes to reach significant financial milestones, such as early retirement or substantial investment portfolios.

Calculating Your 20% Target

To effectively set your 20% target, begin by understanding your net income – that’s your income after taxes and other mandatory deductions. If your bi-weekly paycheck is $2,000, for example, your 20% savings target would be $400 per paycheck, or $800 per month. This calculation provides a tangible number to work towards, making the goal less abstract and more actionable.

- Determine Net Income: Calculate your take-home pay after all deductions.

- Multiply by 0.20: This gives you your monthly or per-paycheck savings target.

- Review and Adjust: Ensure this amount is realistic given your current expenses.

If initially 20% seems daunting, start with a smaller, manageable percentage, say 5% or 10%, and gradually increase it as your income grows or expenses decrease. The key is consistency and progress, not perfection from day one. Gradually increasing your savings rate helps you adapt without feeling deprived, making the journey more sustainable.

Understanding your current financial standing and projecting future needs helps solidify this goal. Consider your age, desired retirement age, and any significant purchases or life events on the horizon. These factors will reinforce the importance of your 20% target and motivate you to stick to your automated savings plan.

Choosing the Right Accounts for Automated Savings

Once you’ve committed to the ‘Pay Yourself First’ philosophy and established your 20% savings goal, the next critical step is to select the appropriate accounts for your automated contributions. The right choice of accounts is crucial for optimizing growth, accessing funds when needed, and minimizing tax liabilities. Diversifying your savings across different account types can cater to various financial objectives.

For short-term goals, such as an emergency fund or a down payment on a car, a high-yield savings account (HYSA) is often the best option. These accounts offer better interest rates than traditional savings accounts, ensuring your money grows even while remaining easily accessible. For long-term goals like retirement, investment accounts become indispensable, allowing your money to benefit from market growth.

Key Account Types for Automation

- High-Yield Savings Accounts (HYSAs): Ideal for emergency funds and short-term savings goals. They offer competitive interest rates and liquidity.

- 401(k) or 403(b) Plans: Employer-sponsored retirement accounts offering tax advantages and often employer matching contributions. This is typically the first place to automate retirement savings.

- Individual Retirement Accounts (IRAs – Traditional or Roth): Personal retirement accounts providing tax benefits, allowing you to save beyond employer plans.

- Brokerage Accounts: For long-term investment goals beyond retirement, such as wealth building or specific future purchases. These offer flexibility but no immediate tax advantages.

- Health Savings Accounts (HSAs): A triple-tax-advantaged account for health expenses, also serving as a powerful investment vehicle for retirement if not used for healthcare.

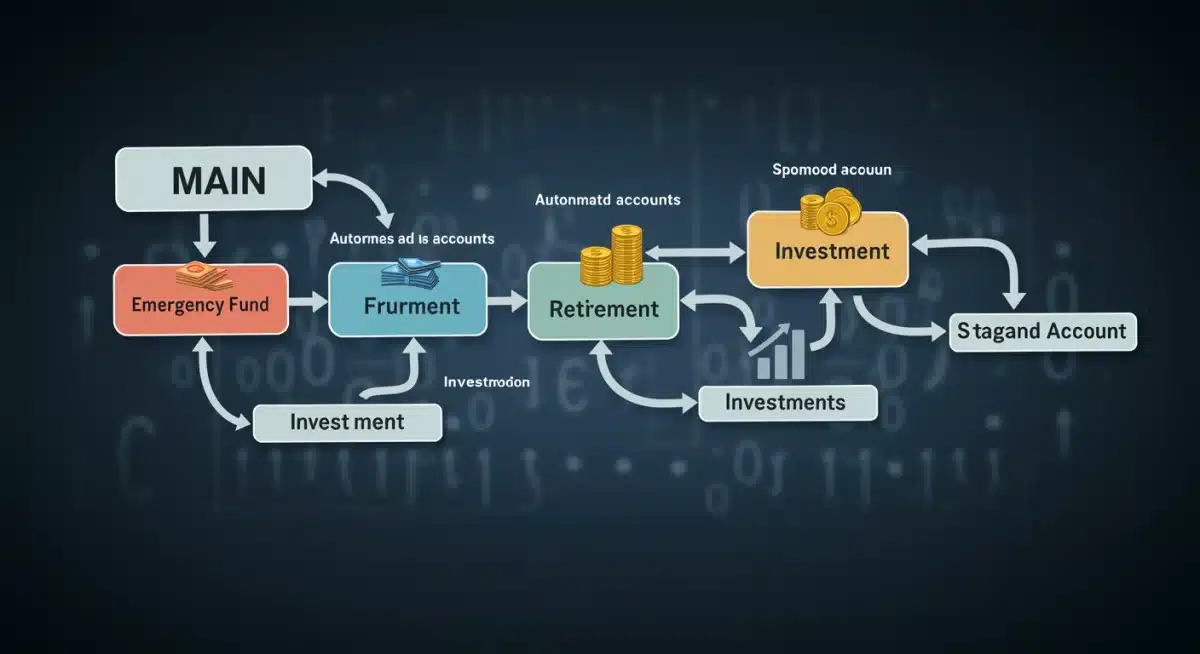

Consider linking your direct deposit to automatically split your paycheck across these accounts. For instance, a portion can go to your HYSA for an emergency fund, another to your 401(k), and a third to your Roth IRA. This seamless distribution ensures your funds are working for you without requiring manual transfers.

Reviewing the features and benefits of each account type, including interest rates, fees, and accessibility, will help you make informed decisions. The goal is to create a diversified portfolio of accounts that align with your financial objectives and risk tolerance, all while leveraging the power of automation.

Implementing Automated Transfers: The Mechanics of ‘Set It and Forget It’

The true power of the ‘Pay Yourself First’ system lies in its automation. The ‘set it and forget it’ approach removes the need for conscious decision-making each pay period, ensuring your 20% savings goal is consistently met without effort or willpower. Implementing automated transfers is simpler than it might seem, thanks to modern banking and financial technology.

The first step is to log into your online banking portal or contact your HR department for direct deposit instructions. Most employers offer the option to split your paycheck into multiple accounts. You can designate a fixed amount or a percentage of your pay to go directly into your savings and investment accounts on payday. This means the money never even hits your checking account, preventing the temptation to spend it.

Practical Steps for Automation

- Direct Deposit Split: The most efficient method. Instruct your employer to route a percentage of your salary directly to your savings, investment, or retirement accounts.

- Recurring Bank Transfers: If direct deposit splitting isn’t an option, set up automatic transfers from your checking account to your savings and investment accounts for the day after your paycheck typically clears.

- Investment Platform Automation: Many brokerage and retirement platforms allow you to set up recurring contributions directly from your bank account.

It’s crucial to schedule these transfers to occur immediately after you get paid. This ensures that your savings are prioritized before any other expenses. For example, if you get paid on the 1st and 15th of the month, set your automated transfers for the 1st and 16th. This timing eliminates the possibility of accidentally spending your savings.

Regularly review your automated transfers, especially after a raise or a change in financial goals. You might find opportunities to increase your savings rate beyond the initially targeted 20%. The beauty of automation is its adaptability; you can adjust the amounts or destinations of your transfers as your financial situation evolves, always maintaining control while benefiting from the system’s consistency.

Optimizing Your Spending to Support 20% Savings

While automating your savings is essential, optimizing your spending habits plays an equally vital role in successfully achieving and maintaining a 20% savings rate. It’s not just about what you save, but also about how you manage what you spend. A careful review of your expenses can uncover areas where adjustments can be made without significantly impacting your quality of life.

Start by tracking your expenses for a month or two. This provides a clear picture of where your money is actually going. Many people are surprised to discover how much they spend on discretionary items like dining out, subscriptions, or impulse purchases. Identifying these ‘money leaks’ is the first step toward making informed changes.

Strategies for Spending Optimization

- Budgeting Apps and Tools: Utilize modern budgeting apps to categorize and monitor your spending in real-time. This awareness is key to making conscious choices.

- The 50/30/20 Rule: Aim to allocate 50% of your net income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a flexible framework for managing your spending.

- Negotiate Bills: Regularly review and negotiate recurring bills such as internet, insurance, and cable. A quick phone call can often result in significant annual savings.

- Minimize Unnecessary Subscriptions: Audit your monthly subscriptions and cancel those you no longer use or need.

Small, consistent changes in spending can free up significant funds that can then be redirected towards your automated savings. For example, packing your lunch a few times a week instead of buying it can save hundreds of dollars a year. These seemingly minor adjustments accumulate over time, bolstering your ability to meet or even exceed your 20% savings goal.

The goal isn’t deprivation, but conscious consumption. By aligning your spending with your values and financial goals, you create a harmonious financial ecosystem where saving comes naturally. This optimization process is dynamic; it requires periodic review and adjustment to ensure it remains effective and supportive of your automated savings strategy.

Reviewing and Adjusting Your Automated System for 2026 and Beyond

A successful automated financial system isn’t a static setup; it’s a dynamic process that requires periodic review and adjustment. As your income, expenses, and financial goals evolve throughout 2026 and into the future, your ‘Pay Yourself First’ system should adapt accordingly. This proactive approach ensures your automation remains optimized for your current circumstances and continues to serve your long-term objectives.

Schedule a quarterly or semi-annual financial review. During this time, assess your progress against your 20% savings goal. Are you consistently hitting it? Have your income levels changed? Have new financial goals emerged, such as saving for a home renovation or a child’s education? These questions will guide your adjustments.

Factors Triggering Adjustments

- Income Changes: A raise or bonus should prompt an increase in your automated savings. Conversely, a decrease in income may necessitate a temporary adjustment to your savings rate.

- Major Life Events: Marriage, the birth of a child, a new home, or career changes all impact your financial landscape and may require re-evaluating your automated contributions.

- Achieved Goals: Once an emergency fund is fully funded, you can redirect those automated contributions to other goals, such as retirement or investment accounts.

- Inflation and Economic Shifts: Monitor economic indicators. While your percentage might remain, the actual dollar amount saved might need to be adjusted to maintain its purchasing power.

Don’t be afraid to fine-tune your system. If you find you’re consistently exceeding your savings goal without feeling stretched, consider increasing your automated contribution. If you’re struggling to meet the 20% target, analyze your spending for areas where you can cut back, or temporarily reduce the percentage until your financial situation improves. The flexibility of an automated system is one of its greatest strengths.

Staying informed about new financial products and technologies can also lead to optimizations. For example, new high-yield savings accounts or investment platforms might offer better returns or lower fees. Regularly seeking insider knowledge and staying abreast of financial trends ensures your automated system remains cutting-edge and effective for years to come.

| Key Strategy | Brief Description |

|---|---|

| Pay Yourself First | Prioritize savings before expenses, making it a non-negotiable financial commitment. |

| 20% Savings Goal | Aim to save 20% of your net income to accelerate financial independence. |

| Automated Transfers | Set up direct deposits or recurring transfers to savings/investment accounts. |

| Regular Review | Periodically assess and adjust your system to align with evolving financial goals and circumstances. |

Frequently Asked Questions About Automated Savings

‘Pay Yourself First’ means prioritizing your savings and investments by automatically setting aside a portion of your income the moment you receive it, before paying bills or discretionary spending. For 2026, it’s about making your financial future a non-negotiable expense.

A 20% savings goal is widely recommended because it provides a significant boost to wealth accumulation without overly restricting current lifestyle. It’s an effective balance for achieving financial independence and securing retirement within a reasonable timeframe, especially for 2026 planning.

Optimal accounts include high-yield savings accounts for emergencies, 401(k)s/403(b)s for employer-sponsored retirement, IRAs (Traditional or Roth) for personal retirement, and brokerage accounts for general investments. HSAs also offer unique triple-tax advantages for health and retirement savings.

It’s advisable to review your automated savings system at least quarterly or semi-annually. This allows you to adjust contributions based on income changes, new financial goals, or major life events, ensuring your system remains aligned with your evolving financial landscape for 2026 and beyond.

Absolutely. The most important thing is to start somewhere. Begin with a smaller, manageable percentage, such as 5% or 10%, and gradually increase it as your income grows or expenses decrease. Consistency is more crucial than the initial percentage when building strong financial habits.

Conclusion

Automating Your 2026 Finances: Setting Up a ‘Pay Yourself First’ System for 20% Savings (Insider Knowledge) is not merely a financial strategy; it’s a commitment to your future self. By embracing the ‘Pay Yourself First’ philosophy, setting a clear 20% savings goal, strategically choosing the right accounts, and diligently implementing automated transfers, you lay a solid foundation for lasting financial security. Remember, the journey to financial freedom is dynamic, requiring periodic review and adjustment to ensure your automated system remains aligned with your evolving life and financial aspirations. Start today, and empower your 2026 self with the gift of a secure financial future.