Maximize Savings: High-Yield Account Rates Guide for January 2025

Maximizing Your Savings: A Guide to the Updated High-Yield Savings Account Rates for January 2025 provides essential insights into leveraging high-yield savings accounts to grow your money, focusing on the best rates and strategies available as of January 2025 for US residents.

Are you looking to supercharge your savings? Discover the latest high-yield savings account rates and strategies for January 2025 with our comprehensive guide to maximizing your savings: a guide to the updated high-yield savings account rates for January 2025.

Understanding High-Yield Savings Accounts

High-yield savings accounts (HYSAs) have become increasingly popular as a way to earn more interest on your savings compared to traditional savings accounts. Understanding the basics of these accounts is crucial for anyone looking to maximize your savings: a guide to the updated high-yield savings account rates for January 2025.

What is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that offers a significantly higher interest rate than traditional savings accounts. These accounts are typically offered by online banks and credit unions, which often have lower overhead costs and can pass those savings on to their customers in the form of higher interest rates.

Why Choose a High-Yield Savings Account?

The primary benefit of a HYSA is the higher interest rate. Over time, this can lead to a substantial increase in your savings, especially when compared to the minimal interest earned in a standard savings account. Another advantage is that HYSAs are typically insured by the FDIC (Federal Deposit Insurance Corporation), up to $250,000 per depositor, per insured bank.

- Higher interest rates compared to traditional savings accounts.

- FDIC insurance for up to $250,000.

- Easy access to your funds when you need them.

- A safe and reliable way to grow your savings.

Choosing a high-yield savings account can be a smart financial decision. These accounts offer a secure and effective way to grow your wealth, making them an attractive option for both short-term and long-term savings goals.

Key Factors Influencing HYSA Rates in January 2025

Several factors influence the interest rates offered on high-yield savings accounts. These factors are dynamic and can change frequently, making it essential to stay informed. For anyone looking to maximize your savings: a guide to the updated high-yield savings account rates for January 2025, understanding these influences is key.

Economic Conditions

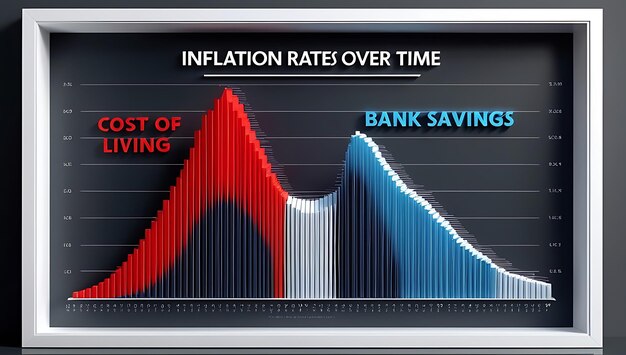

The overall economic climate plays a significant role in determining HYSA rates. Factors, such as inflation, unemployment rates, and economic growth, can all affect the decisions made by financial institutions regarding interest rates. When the economy is strong, interest rates tend to rise, and vice versa.

Federal Reserve Policies

The Federal Reserve (the Fed) has a direct impact on interest rates through its monetary policy. Actions, such as adjusting the federal funds rate, can influence the rates that banks offer on savings accounts. Keeping an eye on Fed announcements and policy changes is crucial for predicting movements in HYSA rates.

- Inflation rates impacting real returns on savings.

- The Federal Reserve’s monetary policy decisions.

- Competitive pressures among banks.

- Changes in the overall economic outlook.

Understanding these interconnected factors will help you make informed decisions when choosing a HYSA. Staying informed allows you to take advantage of favorable conditions and maximize your savings: a guide to the updated high-yield savings account rates for January 2025.

Top High-Yield Savings Accounts to Consider for January 2025

Identifying the best high-yield savings accounts can be a daunting task, given the vast number of options available. However, some stand out due to their competitive rates, low fees, and user-friendly platforms. For those aiming to maximize your savings: a guide to the updated high-yield savings account rates for January 2025, here are some top contenders:

Online Banks

Many online banks offer some of the most competitive HYSA rates. These banks often have lower overheads compared to traditional brick-and-mortar institutions, allowing them to offer better rates to their customers.

Credit Unions

Credit unions are another excellent option, especially for those who prefer a more personalized banking experience. Credit unions are non-profit organizations that often offer better rates and lower fees to their members.

- Marcus by Goldman Sachs: Known for competitive rates and no fees.

- Ally Bank: Offers high-yield savings accounts with no minimum balance.

- Discover Bank: Provides competitive rates and cash-back rewards.

- American Express National Bank: Consistently high rates with a trusted brand.

When selecting a high-yield savings account, consider factors beyond just the interest rate. Also, look at fees, minimum balance requirements, the ease of accessing your funds, and the overall customer experience to ensure you find the best fit for your financial needs, so you can maximize your savings: a guide to the updated high-yield savings account rates for January 2025.

Strategies for Maximizing Your Savings in HYSA

Once you have chosen a high-yield savings account, there are several strategies you can employ to maximize your savings: a guide to the updated high-yield savings account rates for January 2025. These strategies focus on optimizing your savings habits and making the most of the interest earned.

Automated Savings

Setting up automated transfers from your checking account to your HYSA can help you save consistently without having to think about it. Automating the savings process ensures that you are regularly contributing to your savings goals.

Compounding Interest

Take advantage of the power of compounding interest by leaving your interest earnings in the account. Compounding allows you to earn interest not only on your initial deposit but also on the interest you have already earned.

- Set up automatic transfers to your HYSA.

- Reinvest the interest earned to take advantage of compounding.

- Avoid withdrawing funds unless absolutely necessary.

- Regularly review and adjust your savings goals.

By implementing these simple yet effective strategies, you can significantly increase your savings over time. The key is consistency and discipline in your savings habits, allowing you to maximize your savings: a guide to the updated high-yield savings account rates for January 2025.

Potential Risks and How to Mitigate Them

While high-yield savings accounts are generally considered safe, there are still potential risks to be aware of. Understanding these risks and how to mitigate them is crucial for responsible financial management. To maximize your savings: a guide to the updated high-yield savings account rates for January 2025, consider the following:

Inflation Risk

One of the primary risks is inflation. If the inflation rate is higher than the interest rate on your HYSA, the purchasing power of your savings will decrease over time as inflation may occur. To mitigate this risk, consider investing in assets that tend to outpace inflation, such as stocks or real estate.

Interest Rate Fluctuations

HYSA rates can fluctuate based on economic conditions and Federal Reserve policies. If rates decline, the interest earned on your savings will also decrease. To manage this risk, shop around for the best current rates and consider diversifying your savings across multiple accounts.

It’s also important to be aware of any fees a bank may charge, although most HYSAs don’t have them. Always read the fine print to ensure you understand all the terms and conditions and remember to maximize your savings: a guide to the updated high-yield savings account rates for January 2025.

- Monitor inflation rates to ensure your savings outpace inflation.

- Shop around for the most competitive interest rates.

- Consider diversifying your savings across multiple accounts.

- Understand the terms and conditions of your HYSA.

Understanding these risks will help you make well-informed decisions as you maximize your savings: a guide to the updated high-yield savings account rates for January 2025. Risk mitigation is a key part of secure savings and reaching your financial goals.

Future Trends in High-Yield Savings Accounts

The landscape of high-yield savings accounts is constantly evolving, with new trends and technologies emerging. Staying ahead of these trends can help you make informed decisions and optimize your savings strategy going forward, specifically so you can maximize your savings: a guide to the updated high-yield savings account rates for January 2025.

Digital Banking Innovations

Advances in digital banking technology are making HYSAs more accessible and user-friendly. Features, such as mobile banking apps, automated savings tools, and personalized financial advice, are becoming increasingly common.

Increased Competition

The growing popularity of high-yield savings accounts is driving increased competition among banks and credit unions. This competition can lead to even higher interest rates and more attractive features for consumers.

- The rise of digital banking and mobile apps.

- Increased competition among financial institutions.

- Potential for higher interest rates and better features.

- The integration of AI and personalized financial advice.

By staying informed about these trends, you can position yourself to take advantage of the latest innovations and maximize your savings: a guide to the updated high-yield savings account rates for January 2025. Keeping a pulse on how savings accounts continue to evolve is an important part of keeping your savings on track.

| Key Point | Brief Description |

|---|---|

| 💰 Higher Interest | Earn more on your savings compared to traditional accounts. |

| 🛡️ FDIC Insured | Your deposits are protected up to $250,000 per depositor, per insured bank. |

| 📱 Digital Access | Manage your savings easily through online banking and mobile apps. |

| 📈 Rate Monitoring | Stay informed about rate changes to optimize your savings strategy. |

Frequently Asked Questions

▼

A HYSA is a savings account that offers a higher interest rate than traditional savings accounts. They are typically offered by online banks and credit unions due lower overhead costs.

▼

Consider the interest rate, any fees, minimum balance requirements, ease of access to funds, and overall customer experience when selecting a high-yield savings account for your savings.

▼

Yes, most HYSAs are insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor, per insured bank, making them very safe.

▼

Yes, interest rates on HYSAs can fluctuate based on economic conditions and Federal Reserve policies. Be sure to monitor the rate changes for your HYSA regularly.

▼

Set up automated transfers, reinvest the interest earned, avoid unnecessary withdrawals, and regularly review and adjust your savings goals to help maximize your savings.

Conclusion

In conclusion, high-yield savings accounts provide a powerful tool for anyone looking to grow their savings effectively and securely. By staying informed on rate trends, making consistent contributions, and carefully choosing your savings strategy, you can take full advantage of the power of HYSAs and achieve your financial goals.