Student Loan Scams: How to Protect Yourself in 2025

Student loan scams are on the rise, promising quick fixes or loan forgiveness, but ultimately aiming to steal your money and personal information; protect yourself by being aware of common schemes and verifying any offers with official sources.

Are you worried about student loan scams: protect yourself from fraudulent offers and schemes in 2025? With the increasing complexity of student loan repayment programs, scams are becoming more sophisticated. It’s crucial to stay informed and proactive to avoid falling victim to fraud.

Understanding the Landscape of Student Loan Scams

The world of student loans can be confusing, which unfortunately creates fertile ground for scammers. As we move into 2025, it’s essential to understand the current trends and tactics they use to target borrowers.

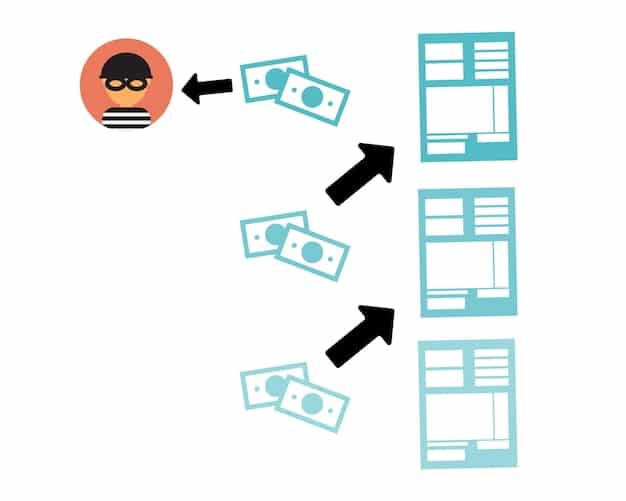

Scammers often prey on borrowers’ anxieties about their debt. They promise quick fixes, loan forgiveness, or reduced monthly payments, often for an upfront fee. However, these promises are usually too good to be true.

Common Types of Student Loan Scams

Recognizing the different forms that scams take is your first line of defense. Here are some common types:

- Upfront Fee Scams: Scammers charge upfront fees for services that are either free or nonexistent.

- Loan Forgiveness Scams: False promises of immediate loan forgiveness, often targeting those eligible for legitimate programs.

- Debt Relief Scams: Offers to consolidate or settle your loans for a fee, with no guarantee of success.

- Phishing Scams: Using fake emails or phone calls to trick you into providing personal or financial information.

Being aware of these common scam types can help you identify and avoid potentially harmful situations. Remember, legitimate loan servicers and government agencies will never demand immediate payment or ask for your sensitive information over the phone.

Red Flags and Warning Signs

Identifying red flags is crucial for protecting yourself. Scammers often use similar tactics, so knowing what to look for can help you stay one step ahead.

Be skeptical of unsolicited offers and high-pressure sales tactics. Scammers often try to rush you into making a decision before you have time to research or think it through.

Key Warning Signs to Watch Out For

- Unsolicited Offers: Be wary of emails or phone calls you didn’t initiate.

- Upfront Fees: Legitimate loan servicers don’t charge upfront fees for assistance.

- Promises of Immediate Forgiveness: Loan forgiveness is rare and typically requires specific qualifications.

- Requests for Sensitive Information: Never provide your FSA ID or bank account details to unsolicited contacts.

Always verify any offer with your loan servicer or the U.S. Department of Education. Don’t be afraid to ask questions and take your time before making any decisions.

How Scammers Target Borrowers

Understanding how scammers operate can help you avoid their traps. They use various methods to target borrowers, often exploiting vulnerabilities and fears.

Scammers often use social media and online advertising to reach a wider audience. They create fake websites that mimic official government or loan servicer sites to trick borrowers into providing their information.

Common Tactics Used by Scammers

- Social Media Ads: Fake ads promising quick loan relief or forgiveness.

- Phishing Emails: Emails that appear to be from legitimate loan servicers or government agencies.

- Robocalls: Automated calls offering “special” loan programs or services.

- Impersonation: Posing as representatives from the Department of Education.

By understanding these tactics, you’ll be better equipped to recognize and avoid potential scams. Always double-check the source of any communication and be skeptical of promises that sound too good to be true.

Protecting Your Identity and Finances

Protecting your personal and financial information is critical to preventing student loan scams. Here are some steps you can take to safeguard your data.

Never share your FSA ID, Social Security number, or bank account details with anyone who contacts you unsolicited. These are prime targets for identity theft and financial fraud.

Steps to Protect Yourself

Here are some specific steps you can take to protect your identity and finances from student loan scams:

- Create Strong Passwords: Use unique, complex passwords for all your online accounts.

- Monitor Your Credit Report: Check your credit report regularly for any suspicious activity.

- Be Wary of Unsolicited Contacts: Don’t respond to emails or phone calls you didn’t initiate.

- Verify Information: Before providing any information, verify the legitimacy of the organization or individual.

By taking these precautions, you can significantly reduce your risk of falling victim to student loan scams. Stay vigilant and trust your instincts.

Legitimate Student Loan Relief Options

It’s important to know that there are legitimate options for student loan relief. These programs are offered by the government and reputable loan servicers.

Legitimate programs such as income-driven repayment plans and Public Service Loan Forgiveness (PSLF) can provide significant relief to qualifying borrowers. However, they require meeting specific criteria and completing the necessary paperwork.

Understanding Legitimate Programs

Here are some of the legitimate student loan relief options available:

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payments based on your income and family size.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying payments while working full-time for a qualifying employer.

- Loan Consolidation: Combining multiple federal loans into a single loan, which can simplify repayment.

Always apply for these programs directly through the U.S. Department of Education or your loan servicer. Avoid third-party companies that charge fees for assistance with these services.

Reporting Student Loan Scams

If you suspect you’ve been targeted by a student loan scam, it’s important to report it. Reporting scams can help protect yourself and others from falling victim to similar schemes.

Reporting the scam to the Federal Trade Commission (FTC) and your state’s attorney general can help authorities track and prosecute scammers.

How to Report a Scam

Here’s how you can report a student loan scam:

- Federal Trade Commission (FTC): File a complaint online at ftc.gov/complaint.

- State Attorney General: Contact your state’s attorney general’s office.

- Loan Servicer: Notify your loan servicer about the suspected scam.

Providing detailed information about the scam, including any communication you received and any money you lost, can help authorities in their investigation. By reporting scams, you’re helping to protect yourself and others from fraudulent schemes.

| Key Point | Brief Description |

|---|---|

| ⚠️ Red Flags | Be alert for unsolicited offers and upfront fees. |

| 🛡️ Protection | Protect your personal and financial info; monitor credit. |

| ✅ Legitimate Options | Explore IDR plans and PSLF directly through official sources. |

| 🚨 Reporting | Report scams to FTC and your state’s attorney general. |

Frequently Asked Questions (FAQ)

▼

Common signs include unsolicited offers, requests for upfront fees, promises of immediate loan forgiveness, and demands for your FSA ID or bank account information.

▼

Never share your FSA ID with anyone who contacts you unsolicited. Always log in to official websites to manage your student loans and avoid clicking on suspicious links.

▼

Report the scam to the FTC and your state’s attorney general. Also, notify your loan servicer to alert them to the potential fraud and protect your account.

▼

Yes, there are legitimate programs like Public Service Loan Forgiveness (PSLF) and income-driven repayment plans. Apply directly through the Department of Education, not third-party companies.

▼

Contact your loan servicer or the U.S. Department of Education directly to verify any offer. Do not rely on information provided by unsolicited contacts or suspicious websites.

Conclusion

Protecting yourself from student loan scams in 2025 requires vigilance and awareness. By understanding the common tactics used by scammers, recognizing red flags, and utilizing legitimate resources, you can safeguard your finances and avoid falling victim to fraud. Always verify information, protect your personal data, and report any suspicious activity to the appropriate authorities.