Personal Finance 2025: Budgeting Tips for Stay-at-Home Parents

Personal Finance for Stay-at-Home Parents: Managing Household Budgets Effectively in 2025 involves mastering strategies such as creating a detailed budget, identifying cost-saving measures, utilizing available resources, planning for long-term financial goals, and adapting to changing financial circumstances to ensure financial stability and security.

Navigating the world of personal finance for stay-at-home parents: managing household budgets effectively in 2025 requires a unique set of skills and strategies. As the financial landscape continues to evolve, it’s crucial to stay ahead with innovative approaches to budgeting and saving. Let’s explore how you can make the most of your household income and secure your family’s financial future.

Understanding the Unique Financial Challenges

Stay-at-home parents face distinct financial hurdles. Juggling household expenses with potentially limited or single-income streams requires meticulous planning and resourcefulness. Recognizing these challenges is the first step toward effective financial management.

The Impact of a Single Income

Relying on a single income can strain a household budget. Prioritizing needs over wants and finding creative ways to save become essential. It’s about making every dollar stretch further.

Balancing Family Needs and Financial Goals

Striking a balance between immediate family needs and long-term financial goals, such as retirement or education savings, can be tricky. Setting clear priorities and making informed financial decisions is key.

- Track all income and expenses to understand where your money is going.

- Identify areas where you can cut back without sacrificing essential needs.

- Set realistic financial goals and create a timeline for achieving them.

Effective management includes adapting to irregular income, especially if you’re managing a side business or freelancing while staying at home. Building an emergency fund becomes even more critical in this scenario.

Creating a Detailed Household Budget

A well-structured budget is the cornerstone of effective financial management. By meticulously tracking income and expenses, you gain control over your finances and identify areas for improvement. Here’s how to create a budget tailored to your needs.

Tracking Income and Expenses

Start by listing all sources of income and categorizing your expenses. This provides a clear picture of your financial inflows and outflows. You can use budgeting apps, spreadsheets, or even a simple notebook to keep track.

Categorizing Your Spending

Divide your expenses into fixed (e.g., rent/mortgage, utilities) and variable (e.g., groceries, entertainment) categories. Understanding these distinctions helps you identify flexible spending areas.

- Use budgeting apps like Mint, YNAB (You Need a Budget), or Personal Capital.

- Review bank and credit card statements regularly to track spending.

- Set up alerts for unusual transactions to prevent fraud and overspending.

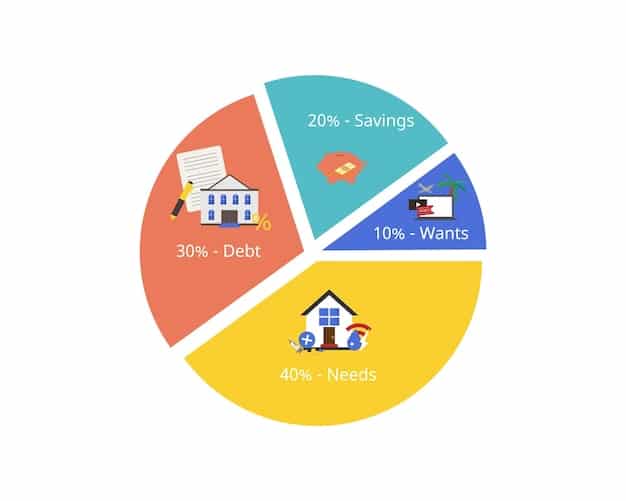

Consider the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. However, adjust these percentages based on your specific financial situation and priorities.

Identifying Cost-Saving Opportunities

Finding areas to cut costs can significantly improve your financial health. Look for savings in your daily expenses, subscriptions, and larger bills. Small changes can add up to substantial savings over time.

Cutting Unnecessary Expenses

Evaluate your subscriptions, memberships, and entertainment expenses. Consider canceling or downgrading services you don’t use frequently.

Negotiating Bills and Finding Discounts

Contact service providers to negotiate lower rates on your bills. Look for discounts and coupons when shopping. Comparison shopping can also lead to significant savings.

Energy Efficient Improvements

Consider the long-term benefits of energy efficient improvements around the house. They can not only have positive impact on the environment, but help to save you money over time as well.

- Shop around for insurance quotes to find the best rates.

- Use coupons and discount codes when shopping online and in stores.

- Take advantage of free activities and events in your local community.

Saving on groceries is another area where stay-at-home parents can excel. Meal planning, buying in bulk, and reducing food waste can lead to significant savings. Also, consider generic brands for everyday items.

Utilizing Available Resources and Support

Many resources and support systems are available to help stay-at-home parents manage their finances. Government programs, community services, and online tools can provide valuable assistance.

Government Assistance Programs

Explore government programs like SNAP (Supplemental Nutrition Assistance Program) or WIC (Women, Infants, and Children) if you meet the eligibility criteria. These programs can help cover essential needs.

Community Services and Support Groups

Local community centers and support groups offer resources like food banks, clothing assistance, and financial counseling. These services can provide immediate relief and long-term guidance.

- Research local charities and non-profit organizations that offer assistance.

- Join online forums and social media groups for stay-at-home parents to share tips and resources.

- Attend free workshops and seminars on financial literacy and budgeting.

Online resources, such as financial blogs, budgeting tools, and investment platforms, can also provide valuable insights and guidance. Take advantage of these free or low-cost resources to improve your financial knowledge.

Planning for Long-Term Financial Goals

While managing day-to-day expenses is crucial, it’s equally important to plan for long-term financial goals. Retirement savings, education funds, and emergency reserves provide financial security and peace of mind.

Saving for Retirement and Education

Even small contributions to retirement accounts and education savings plans can make a big difference over time. Consider opening a Roth IRA or 529 plan to start saving for the future.

Building an Emergency Fund

An emergency fund can protect you from unexpected expenses and financial setbacks. Aim to save at least three to six months’ worth of living expenses in a readily accessible account.

Consider Part-Time Work

With the changing digital landscape, and increased work-from-home options, a possibility is to consider part-time work. The extra income, no matter the size, helps alleviate some of the financial challenges.

- Set up automatic transfers to your savings accounts each month.

- Take advantage of employer-sponsored retirement plans with matching contributions.

- Consider consulting a financial advisor to create a personalized savings plan.

Investing wisely can also help you achieve your long-term financial goals. Diversify your investments and consider consulting with a financial advisor to make informed decisions.

Adapting to Changing Financial Circumstances

Financial circumstances can change unexpectedly. Job loss, health issues, or other unforeseen events can impact your budget. Being prepared and adaptable is crucial to managing these changes effectively.

Adjusting Your Budget as Needed

Regularly review and adjust your budget to reflect changes in income, expenses, or financial goals. Flexibility is key to maintaining financial stability.

Seeking Professional Financial Advice

If you’re facing significant financial challenges, consider seeking advice from a qualified financial advisor. They can provide personalized guidance and help you navigate complex financial issues.

- Stay informed about changes in tax laws and regulations that may affect your finances.

- Develop a contingency plan to address potential financial setbacks.

- Maintain open communication with your spouse or partner about financial matters.

During financial difficulties, prioritize essential needs and explore options for temporary assistance. Communicate with creditors and service providers to negotiate payment plans or deferments.

Leveraging Technology for Financial Management

In 2025, technology plays a pivotal role in personal finance. From budgeting apps to investment platforms, digital tools offer unprecedented convenience and efficiency. Stay-at-home parents can leverage these tools to streamline their financial management.

Utilizing Budgeting Apps and Software

Budgeting apps like Mint, YNAB (You Need a Budget), and Personal Capital provide comprehensive tools for tracking expenses, setting goals, and monitoring progress. These apps offer real-time insights into your financial health.

Exploring Online Banking and Investment Platforms

Online banking and investment platforms offer convenient access to your accounts and investment options. Many platforms also provide educational resources and tools to help you make informed financial decisions.

- Set up automatic bill payments to avoid late fees and missed payments.

- Use online calculators to estimate your retirement savings needs or mortgage payments.

- Enroll in online courses or webinars to improve your financial literacy.

Mobile payment apps like PayPal, Venmo, and Cash App can simplify transactions and help you track spending. Integrate these apps with your budgeting system for a seamless financial management experience.

| Key Point | Brief Description |

|---|---|

| 💰 Budget Creation | Creating a detailed budget to track income and expenses. |

| 📉 Cost Savings | Identifying cost-saving opportunities in daily expenses. |

| 🤝 Support Resources | Utilizing government and community support programs. |

| 🎯 Financial Goals | Planning for long-term savings and emergency funds. |

Frequently Asked Questions

▼

Begin by tracking your income and expenses for a month to understand your spending habits. Then, create a budget allocating funds for needs, wants, and savings, adjusting as necessary.

▼

Many overlook the costs of hobbies, subscriptions, and small daily purchases like coffee. These can add up significantly over time, so be sure to include them in your budget.

▼

Plan your meals, make a grocery list, and stick to it. Buy in bulk when possible and compare prices at different stores. Also, reduce food waste by using leftovers creatively.

▼

Explore government programs like SNAP and WIC. Additionally, local community centers and charities offer resources like food banks, clothing assistance, and financial counseling.

▼

An emergency fund is crucial for unforeseen events like job loss or medical emergencies. Aim to save at least three to six months’ worth of living expenses in a readily accessible account.

Conclusion

Mastering personal finance for stay-at-home parents: managing household budgets effectively in 2025 requires vigilance, adaptability, and a proactive approach. By implementing these strategies, stay-at-home parents can secure their financial future and provide stability for their families, ensuring they are well-prepared for whatever the future holds.