QBI Deduction 2026: Maximize Your 20% Business Income Savings

The Qualified Business Income (QBI) deduction in 2026 offers a substantial opportunity for eligible pass-through entities and sole proprietors to reduce their tax liability by up to 20% on qualified business income, significantly impacting financial planning.

Understanding the Financial Impact of Qualified Business Income (QBI) Deduction in 2026 is crucial for business owners navigating the evolving tax landscape. This deduction, a cornerstone of the Tax Cuts and Jobs Act (TCJA) of 2017, continues to offer a significant opportunity for eligible pass-through entities and sole proprietors to reduce their taxable income.

Understanding the QBI Deduction: A 2026 Perspective

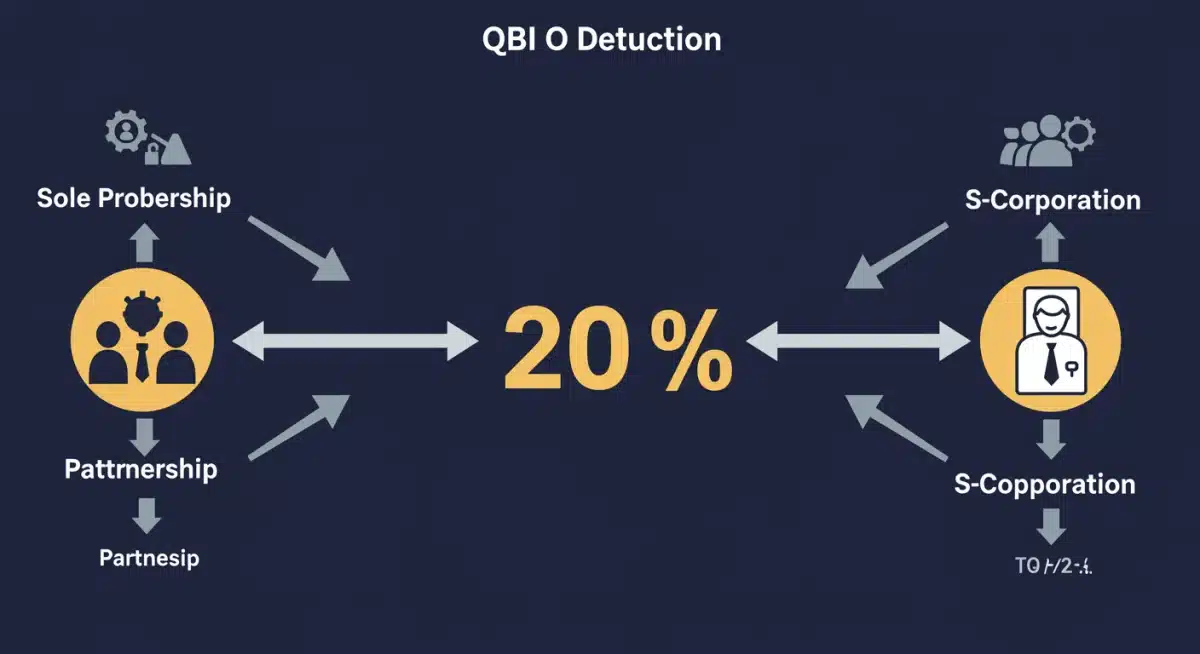

The Qualified Business Income (QBI) deduction, often referred to as the Section 199A deduction, allows eligible self-employed individuals and owners of pass-through businesses to deduct up to 20% of their qualified business income. This provision was designed to provide a tax benefit comparable to the corporate tax rate reduction, aiming to level the playing field for various business structures. As we look towards 2026, the fundamental principles of this deduction remain intact, though it’s always wise to stay abreast of any potential legislative changes or interpretations that could emerge.

The deduction is not an itemized deduction but rather a deduction from adjusted gross income (AGI), available regardless of whether a taxpayer itemizes. This makes it a powerful tool for reducing overall tax liability. The primary goal is to stimulate economic activity by allowing businesses to retain more of their earnings, fostering growth and investment.

Who qualifies for the QBI deduction?

Eligibility for the QBI deduction largely depends on the type of business income and the taxpayer’s taxable income. Most pass-through entities, such as sole proprietorships, partnerships, S-corporations, and certain trusts and estates, can qualify. However, specific service trades or businesses (SSTBs) face limitations based on income thresholds, which are adjusted annually for inflation.

- Sole Proprietorships: Individuals operating a business as a sole proprietor report their income and expenses on Schedule C of Form 1040.

- Partnerships: Partners in a partnership receive a Schedule K-1 reflecting their share of qualified business income.

- S-Corporations: Shareholders of S-corporations also receive a Schedule K-1 detailing their share of QBI.

- Rental Real Estate: Certain rental real estate activities can qualify as a trade or business for QBI purposes, particularly if they meet specific activity thresholds.

Understanding these foundational aspects is the first step in leveraging the QBI deduction effectively in 2026. The complexities lie in the nuances of income thresholds and the classification of business types, which we will explore further to ensure you can maximize your potential savings.

Navigating Income Thresholds and Limitations for 2026

For 2026, the QBI deduction continues to be subject to specific income thresholds that significantly impact its availability and calculation, particularly for specified service trades or businesses (SSTBs). These thresholds are adjusted annually for inflation and determine whether the deduction is fully available, partially available, or completely phased out. Staying informed about these figures is paramount for effective tax planning.

When a taxpayer’s taxable income falls below the lower threshold, the QBI deduction is generally available without limitation, regardless of whether the business is an SSTB. This provides a clear benefit for smaller businesses and individuals with moderate incomes. However, as taxable income rises above this threshold, the rules become more intricate.

Impact on specified service trades or businesses (SSTBs)

SSTBs include professions such as health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, and brokerage services. For these businesses, the QBI deduction begins to phase out once the taxpayer’s taxable income exceeds the lower threshold. Once it reaches the upper threshold, the deduction is entirely disallowed for SSTBs.

- Lower Threshold: Below this amount, SSTBs are treated like any other qualified trade or business.

- Phase-out Range: Within this range, the deduction for SSTBs gradually reduces.

- Upper Threshold: Above this amount, SSTBs are completely ineligible for the QBI deduction.

For non-SSTBs, the income thresholds introduce different limitations related to W-2 wages paid by the business and the unadjusted basis immediately after acquisition (UBIA) of qualified property. These limitations come into play only when a taxpayer’s income exceeds the upper threshold. This ensures that the deduction primarily benefits businesses with substantial payrolls or significant capital investments.

Careful planning and accurate income projections are essential to navigate these thresholds and ensure compliance. Business owners should consult with tax professionals to understand how these limits apply to their specific circumstances in 2026.

Calculating Your QBI Deduction: Key Components

The calculation of the QBI deduction involves several key components that must be accurately determined to arrive at the correct deduction amount. Understanding these elements is fundamental to securing the maximum possible benefit. The calculation isn’t always straightforward, requiring attention to detail and a clear understanding of what constitutes qualified business income, W-2 wages, and qualified property.

The starting point is always the qualified business income itself. This generally includes the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business. However, certain types of income, such as capital gains, dividends, interest income, and reasonable compensation paid to an S-corporation shareholder, are specifically excluded from QBI. This distinction is vital for accurate reporting.

W-2 wages and unadjusted basis of qualified property (UBIA)

For taxpayers whose taxable income exceeds the upper threshold, the QBI deduction is subject to one of two limitations: the W-2 wage limitation or the W-2 wage and unadjusted basis immediately after acquisition (UBIA) of qualified property limitation. The deduction is limited to the lesser of 20% of QBI or the greater of:

- 50% of the W-2 wages paid by the qualified trade or business, or

- 25% of the W-2 wages paid by the qualified trade or business plus 2.5% of the unadjusted basis immediately after acquisition (UBIA) of qualified property.

The W-2 wages include the total wages paid by the business to its employees, including amounts subject to income tax withholding and elective deferrals. UBIA refers to the original cost of tangible depreciable property held by the business at the end of the tax year. This property must be used in the production of QBI and its depreciable period must not have ended before the close of the tax year.

These calculations can be complex, especially for businesses with significant assets or fluctuating payrolls. Maintaining meticulous records of wages paid and property acquisitions is essential for accurately determining the QBI deduction in 2026.

Strategic Planning for Maximizing Your 2026 QBI Deduction

Proactive strategic planning is key to maximizing your QBI deduction in 2026. Given the deduction’s complexities, especially with income thresholds and limitations for SSTBs, a well-thought-out approach can lead to substantial tax savings. This involves not only understanding the rules but also implementing strategies that align with your business operations and financial goals.

One primary strategy involves managing your taxable income to stay within the most favorable thresholds. For SSTBs, this might mean accelerating deductions or deferring income to keep taxable income below the upper threshold, thereby preserving the deduction. For non-SSTBs, managing W-2 wages and qualified property investments can be critical if your income is above the higher threshold.

Considerations for business structure and operations

The choice of business structure itself can influence QBI deduction eligibility. While the deduction applies to pass-through entities, careful consideration of how income is distributed and reported can be beneficial. For example, S-corporation owners must pay themselves a reasonable salary, which is not considered QBI, but the remaining pass-through income may qualify.

- W-2 Wage Optimization: For businesses above the income thresholds, increasing W-2 wages can increase the deduction limit. This might involve hiring more employees or adjusting compensation structures.

- Qualified Property Investments: Investing in qualified depreciable property can also increase the UBIA component, potentially allowing for a larger deduction.

- Income Splitting: In some cases, income splitting among family members involved in the business can help keep individual taxable incomes below the phase-out thresholds.

Another important aspect is distinguishing between qualified business income and excluded income. Ensuring accurate classification of all income streams will prevent miscalculations and potential issues with the IRS. Regularly reviewing your financial statements and consulting with a tax professional can help identify opportunities for optimization and ensure compliance with the latest regulations for 2026.

Common Pitfalls and How to Avoid Them

Despite the significant benefits of the QBI deduction, many business owners encounter common pitfalls that can lead to errors or missed opportunities. Being aware of these challenges and implementing preventative measures is crucial for a smooth and effective tax filing process in 2026. The complexities surrounding income thresholds, business classifications, and calculation methodologies often contribute to these issues.

One frequent mistake is misclassifying income or expenses, which can directly affect the calculation of qualified business income. For instance, incorrectly including capital gains or interest income as QBI will inflate the deduction, potentially leading to an audit. Conversely, failing to include all eligible business deductions can artificially reduce QBI, thereby lowering the available deduction.

Accurate record-keeping and professional guidance

Poor record-keeping is another significant pitfall. The QBI deduction relies heavily on accurate documentation of business income, expenses, W-2 wages, and qualified property. Without detailed and organized records, substantiating your deduction claims can become challenging, especially if your return is selected for review by the IRS.

- Income Threshold Miscalculations: Failing to account for annual inflation adjustments to the income thresholds can lead to incorrect deduction amounts, particularly for SSTBs.

- SSTB Classification Errors: Incorrectly determining if your business is an SSTB can result in either an overstatement or understatement of the deduction.

- Ignoring W-2 Wage/UBIA Limitations: For higher-income taxpayers, overlooking the W-2 wage and UBIA limitations can lead to an incorrect deduction calculation.

Seeking professional guidance from a qualified tax advisor is one of the most effective ways to avoid these pitfalls. Tax professionals can help interpret complex regulations, ensure accurate calculations, and provide tailored strategies for your specific business situation. Their expertise can be invaluable in navigating the intricacies of the QBI deduction in 2026, saving you time, money, and potential headaches.

Future Outlook: QBI Deduction Beyond 2026

As we plan for 2026 and leverage the current benefits of the QBI deduction, it’s equally important to consider its future outlook. The QBI deduction, a temporary provision of the Tax Cuts and Jobs Act (TCJA) of 2017, is currently scheduled to expire at the end of 2025. This means that without legislative action, the deduction will no longer be available for tax years beginning after December 31, 2025. This looming expiration creates significant uncertainty for long-term financial planning for many businesses.

The potential sunset of the QBI deduction could have a profound impact on pass-through entities and self-employed individuals, potentially increasing their tax burdens significantly. This would necessitate a complete reassessment of business structures, compensation strategies, and overall tax planning. The financial impact could be substantial, affecting cash flow, investment decisions, and profitability.

Potential legislative actions and their implications

While the current legislation sets an expiration date, there is always the possibility of future legislative action. Congress could choose to extend the QBI deduction, make it permanent, or modify it. The political landscape and economic conditions will heavily influence these decisions. Businesses and tax professionals are closely monitoring developments, advocating for clarity and stability.

The debate around extending the QBI deduction will likely revolve around its effectiveness in stimulating economic growth, its cost to the federal budget, and its fairness across different business types. Any changes could introduce new rules, thresholds, or limitations, requiring businesses to adapt their strategies once again.

For now, businesses should plan for the deduction’s expiration while remaining flexible to adapt to any legislative changes. This dual approach involves maximizing the deduction while it’s available in 2026 and simultaneously developing contingency plans for a post-QBI deduction environment. Staying informed through reliable sources and maintaining close communication with tax advisors will be crucial in navigating this evolving landscape.

Real-World Examples: QBI Deduction in Practice

To truly grasp the practical implications of the QBI deduction, examining real-world examples can be incredibly insightful. These scenarios illustrate how various business owners can benefit from this provision, highlighting the importance of understanding the rules and applying them correctly. The diversity of business structures and income levels means the deduction’s impact can vary significantly.

Consider a sole proprietor, a freelance graphic designer, whose taxable income is below the lower threshold for 2026. If their qualified business income is $70,000, they could deduct 20% of that amount, resulting in a $14,000 reduction in their taxable income. This direct reduction translates into substantial tax savings, freeing up capital for business investment or personal use.

Case studies across different business types

Another example involves partners in a small consulting firm, an SSTB, whose combined taxable income falls within the phase-out range. If their qualified business income is $300,000 and their W-2 wages are $100,000, the deduction calculation becomes more complex. The deduction would still be available, but it would be limited based on their income and a proportionate reduction due to being an SSTB within the phase-out. This necessitates careful calculation to ensure compliance and maximize the remaining deduction.

- S-Corporation Owner: An S-Corp owner with $150,000 in qualified business income and $50,000 in reasonable W-2 wages. The QBI deduction would be calculated on the $150,000, subject to the overall taxable income and W-2 wage limitations.

- Rental Real Estate Investor: A real estate investor who materially participates in their rental activities, generating $100,000 in qualified rental income. This income could qualify for the QBI deduction, providing significant tax relief on their investment.

- Manufacturing Business: A manufacturing business with substantial qualified property and W-2 wages, whose owners have taxable income above the upper threshold. Their deduction would be limited by the W-2 wage and UBIA rules, emphasizing the importance of these factors for larger enterprises.

These examples underscore that while the QBI deduction offers broad benefits, its application is highly individualized. Each business must assess its unique financial situation, income levels, and operational specifics to accurately calculate and claim the deduction. Professional advice remains invaluable in navigating these real-world complexities and ensuring optimal outcomes.

| Key Aspect | Brief Description |

|---|---|

| Eligibility | Applies to pass-through entities and sole proprietors for up to 20% of QBI. |

| Income Thresholds | Limits deduction, especially for specified service trades or businesses (SSTBs). |

| Calculation Factors | Involves QBI, W-2 wages, and unadjusted basis of qualified property (UBIA). |

| Expiration | Currently set to expire at the end of 2025 unless extended by Congress. |

Frequently Asked Questions About the QBI Deduction in 2026

The Qualified Business Income (QBI) deduction allows eligible self-employed individuals and owners of pass-through businesses to deduct up to 20% of their qualified business income. For 2026, the rules largely follow previous years, offering significant tax savings by reducing taxable income for qualified entities.

Yes, the QBI deduction is subject to income thresholds, which are adjusted annually for inflation. These limits can reduce or eliminate the deduction, especially for specified service trades or businesses (SSTBs), if your taxable income exceeds certain amounts. It’s crucial to check the most current IRS guidelines for 2026.

Most pass-through entities, including sole proprietorships, partnerships, S-corporations, and certain trusts and estates, are eligible. Specified service trades or businesses (SSTBs) are also eligible below certain income thresholds but face limitations as income rises.

Maximizing the QBI deduction involves strategic tax planning, such as managing your taxable income to stay within favorable thresholds, optimizing W-2 wages if your income is high, and investing in qualified depreciable property. Consulting a tax professional is highly recommended for personalized strategies.

Currently, the Qualified Business Income (QBI) deduction is scheduled to expire at the end of 2025. This means that without new legislative action, it will not be available for tax years beginning after December 31, 2025. Businesses should prepare for this potential change.

Conclusion

The Qualified Business Income (QBI) deduction remains a powerful tax incentive for eligible businesses in 2026, offering substantial opportunities to reduce tax liabilities by up to 20% of qualified business income. Navigating the intricacies of eligibility, income thresholds, and calculation methods is paramount for maximizing this benefit. While the deduction’s future beyond 2026 remains uncertain due to its scheduled expiration, proactive planning and informed decision-making are essential. Business owners should leverage expert tax advice, maintain meticulous records, and stay abreast of potential legislative changes to fully capitalize on the financial impact of the QBI deduction while it is available.