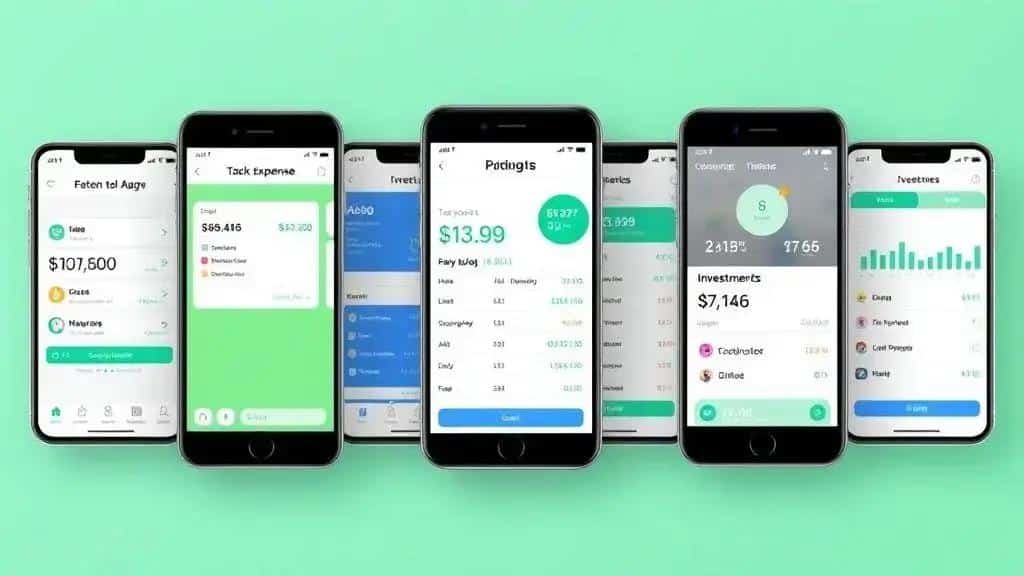

Personal finance apps: take control of your budget now

Personal finance apps help users manage their money effectively by providing tools for budgeting, tracking expenses, and setting savings goals, with popular options like Mint, YNAB, and Personal Capital available in 2023.

Personal finance apps have become invaluable tools for anyone looking to manage their money effectively. Have you ever wondered how these apps can truly transform your budgeting habits? Let’s explore their benefits and features.

What are personal finance apps?

Every day, more people are turning to personal finance apps to track their spending and save money. These tools are user-friendly and designed to simplify managing your finances.

Understanding Personal Finance Apps

Personal finance apps are software applications that help users manage their personal financial activities. They can assist with budgeting, expense tracking, and even investment management. The best part? Most of them are available on your smartphone.

Key Features of Personal Finance Apps

When choosing a personal finance app, look for features that suit your needs. A good app should:

- Provide real-time expense tracking

- Enable budget creation and management

- Include tools for saving and investment tracking

- Offer bank account integration for easier management

These features ensure that you stay informed about your financial health, giving you insights into your spending habits. By using these apps regularly, you can develop a clearer picture of your finances.

Some popular personal finance apps include Mint, YNAB (You Need A Budget), and PocketGuard. Each of these apps has unique features that cater to different financial needs. Whether you’re a student managing a tight budget or someone saving for retirement, there’s an app that can help.

By effectively using a personal finance app, budgeting becomes less of a chore and more of a rewarding experience. You can set financial goals and track your progress right from your device. This not only makes managing money easier but also helps in maintaining a healthy relationship with your finances.

Why Use Personal Finance Apps?

Using a personal finance app can streamline your financial processes. For instance, tracking expenses can help you identify where you spend too much. This knowledge empowers you to make informed decisions and adjust your habits accordingly.

Ultimately, personal finance apps can turn your financial chaos into clarity. They provide valuable insights that help you budget better, save for future goals, and make informed decisions on your spending. With the right app, you gain control over your financial destiny.

Key features to look for in finance apps

When selecting a personal finance app, it’s essential to consider various features that can enhance your financial management. Understanding these features can help you choose an app that best suits your needs.

Essential Features of Personal Finance Apps

The right app can make a significant difference in your budgeting experience. Some vital features include:

- Real-time expense tracking: This feature allows you to monitor your spending as it happens, providing immediate insights into your financial habits.

- Automated budgeting tools: Many apps offer tools that automate the budgeting process, making it easier to allocate funds to different categories according to your financial goals.

- Bill reminders: Staying on top of your bills is crucial for maintaining a good credit score. An app that sends reminders can help you avoid late fees.

- Investment tracking: If you have investments, it’s helpful to use an app that can track their performance and provide insights into portfolio management.

Integrating these features into your financial routine can lead to better money management. For instance, real-time expense tracking combined with bill reminders can prevent overspending and missed payments.

Another helpful feature to consider is bank synchronization. This allows the app to connect directly with your bank accounts, updating your transactions automatically. Such synchronization reduces the need for manual input, saving time and minimizing the risk of errors.

User-friendly interface is also critical. An intuitive design makes it easier to navigate the app and utilize its features. This can enhance your experience, encouraging you to engage more actively with managing your finances.

In the current market, numerous apps offer a mix of features. It’s beneficial to read user reviews to see how well these features function in real-life scenarios. With the right app, achieving your financial goals can become more straightforward and less stressful.

How personal finance apps can boost savings

Personal finance apps are not just for tracking expenses; they can also play a vital role in boosting your savings. By integrating these tools into your daily financial routine, you can discover numerous ways to save money effectively.

Setting Savings Goals

Many apps offer the feature to set specific savings goals. This means you can easily allocate money towards items you want or need, like a vacation or a new gadget. By visualizing your goals, you’ll be more motivated to stick to your budget.

Automatic Savings Features

Some apps come with automatic savings features that transfer small amounts of money to your savings account regularly. This process can help you save without even thinking about it. You can set it up to round up purchases to the nearest dollar or transfer a percentage of your paycheck automatically.

- Rounding Up: This feature will take your purchases, round them up, and save the difference.

- Paycheck Percentage: Setting aside a fixed percentage from each paycheck can make saving easier.

- Recurring Transfers: Schedule transfers to your savings on a daily, weekly, or monthly basis.

Additionally, personal finance apps provide insights through analytics. They can show you where you’re overspending and suggest areas to cut back. For example, by reviewing your monthly expenses, you can identify subscriptions you no longer use and eliminate them. This not only saves money but also helps increase your savings.

Moreover, many apps allow you to track your progress toward your savings goals. Watching your savings grow can be incredibly satisfying. You can see how well you are doing, and this sense of achievement can encourage you to save even more.

To maximize savings, consider using your app’s budgeting tools. By creating a budget, you can determine how much you can save each month. Balancing your budget effectively means there might be extra funds available for savings.

Top personal finance apps for 2023

As we look into 2023, several personal finance apps stand out for their ability to help users manage money effectively. Each app has unique features that cater to different financial needs.

1. Mint

Mint is one of the most popular personal finance apps on the market. It offers a comprehensive view of your finances by aggregating your bank accounts, credit cards, and investment accounts. With its user-friendly interface, Mint helps you create budgets, track expenses, and set financial goals. The app also sends alerts for bill due dates, ensuring you stay on top of your payments.

2. YNAB (You Need A Budget)

YNAB is perfect for those who want a hands-on approach to budgeting. This app teaches you how to allocate every dollar you earn, helping you to plan for future expenses and save effectively. YNAB promotes the idea that budgeting should be proactive rather than reactive, which can lead to better financial habits.

3. Personal Capital

For users focused on investments and long-term financial planning, Personal Capital combines budgeting with wealth management tools. It offers features like retirement planning calculators and investment tracking. This helps users keep track of their net worth and optimize their investment strategies.

4. PocketGuard

PocketGuard simplifies budgeting by showing how much disposable income you have after accounting for bills, goals, and necessities. Its “In My Pocket” feature helps users understand how much they can spend, making it easier to avoid overspending.

- Real-time expense tracking: See your spending as it happens.

- Security features: Many apps include multi-factor authentication for additional safety.

- Easy navigation: A simple user interface can make managing finances much more accessible.

These top personal finance apps for 2023 can help you take control of your finances. Whether you’re looking to budget, save, or invest, there’s an app that fits your needs.

FAQ – Frequently Asked Questions about Personal Finance Apps

What are personal finance apps used for?

Personal finance apps help users manage their money by providing tools for budgeting, expense tracking, and saving.

How do personal finance apps help with budgeting?

They allow you to set budgets for different spending categories and track your expenses against those budgets in real-time.

Can personal finance apps help me save money automatically?

Yes, many apps offer automatic savings features that transfer small amounts from your checking account to savings based on rules you set.

What are some popular personal finance apps for 2023?

Popular personal finance apps include Mint, YNAB (You Need A Budget), Personal Capital, and PocketGuard.